Looking for something else?

Welcome

BMO Family Office

BMO Delaware Trust Company

BMO Investment Services

*Services offered though BMO Private Bank, BMO Family Office and/or BMO Delaware Trust Company

Looking for something else?

†Service offered through BMO Investment Services

†Service offered through BMO Investment Services

Make sure you’ve spelled everything correctly, or try searching for something else

BMO Family Office

BMO Delaware Trust Company

BMO Investment Services

Looking for something else?

Building and running a successful business can be hugely rewarding, both personally and financially, but it comes at a cost.

Building and running a successful business can be hugely rewarding, both personally and financially, but it comes at a cost. You’ll sacrifice your time, energy, work/life balance and perhaps even your life savings to make your enterprise a success. You do this in the hope that your business will be your career, your family’s financial support system and, one day, your legacy.

During each phase of its development, your business faces unique challenges. It falls to you to be prepared for the unexpected and make sure your business is resilient, to effectively weather whatever’s around the corner. A solid business plan is perhaps the best line of defense against unforeseen events that could derail your organization. A close second is insurance.

Two common types of insurance for businesses owners are liability insurance and life insurance. Read on to learn more about whether either or both of these could be right for you and your company.

Liability insurance is probably the first insurance product your business is likely to purchase. Its job is to cover potentially devastating financial events such as lawsuits and third-party claims, and prevent hugely expensive legal fees from sinking your company’s finances.

There are various types of liability insurance including: ·

General liability insurance – protects against claims resulting from bodily injuries and/or property damage caused by your company’s products, services or operations; for instance, if a customer slips and is injured on your company's premises.

Professional liability insurance – protects against liabilities arising from errors and/or omissions in yours or your employees’ work. This might include instances of breaches of contract, copyright infringement, mistakes or undelivered services.

Product liability insurance – protects you in case someone claims damage to themselves or their property caused by a faulty product.

The level of coverage these policies offer and the cost of the monthly or annual premium will vary depending on several factors. When you apply for coverage, you will likely need to answer questions about the nature of your business, your premises and sites, turnover, number of employees and more, so that the insurer can determine the likely risk of lawsuits. The insurer will then price your policy accordingly.

As many as one in five businesses fail within their first 12 months after opening, according to the U.S. Bureau of Labor Statistics' data from 2024.1 Start-up life insurance protects a business— and by extension, a family—from the risk of a business failing in its early years.

A newly-purchased business or start-up can carry a high level of risk to a family or a partner in the business. Very often, passionate entrepreneurs bootstrap using their personal savings or borrowed money to get a new business off the ground. When a founder’s personal finances are intertwined with those of their business, they can find their credit score damaged, their savings depleted, and they could even lose their home if they signed a personal guarantee and the business folds owing money to creditors.

If the business owner dies, their family may be left with nothing but debt. That’s why a life insurance policy taken out on the owner of a new business can be a sensible move which could protect the family from financial disaster.

Even if there is more than one owner, one of them dying could lead to the business struggling or declining in value. If the surviving partner wants to continue in the business, they may require capital to hire a new senior executive with the relevant skills to keep the business going. Term life insurance (which covers the policy owner for a set period of time) is relatively inexpensive and can be stopped at any point after the need to protect a family is gone or the business is doing well enough to absorb the hit of an owner's death.

It's up to you to decide how much coverage you'll need. One simple way to come up with an approximate number is to figure out how much money your loved ones would need in order to maintain their lifestyle in your absence.

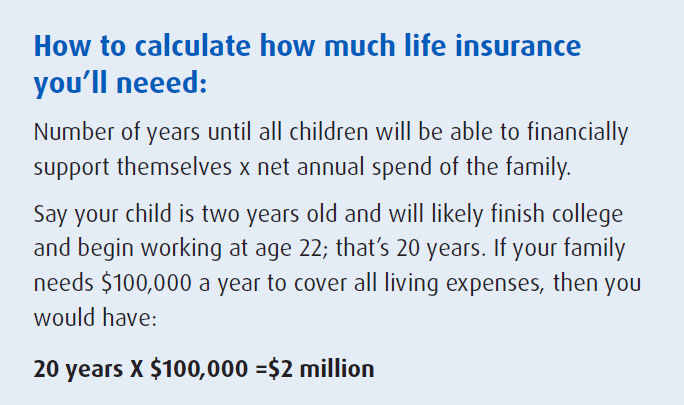

If you have children, you can use this basic formula to calculate what that would be:

In the above example, you’d need a $2 million term life insurance policy to protect the life and health of your family in the event you died before your business could really take off. (You can make adjustments depending on whether or not you have a working spouse that contributes to your family's net annual spend.)

Even if you do not have children, you may still want to consider life insurance to help support your partner or any other family members that depend on your income. In that case, consider the amount you would need to cover any outstanding debts and potentially provide ongoing support for those family members.

As many as one in five businesses fail within their

first 12 months after opening.

Even a highly profitable business needs to keep good management and good employees. To protect against the risks of losing them, life insurance can help with both retention (by encouraging them to stay employed with your company in order to keep the insurance plan) or in the event of their untimely death (by providing a financial benefit to your company if you lose a key employee).

There are several types of life insurance which could make sense for your business depending on which of these goals you want to pursue.

Imagine that your hard work paid off and your company has not only survived but thrived. Now you have a profitable business, supported by valued employees led by a high-calibre management team. You can incentivize your best people to stay with your company by offering life insurance as an employee benefit.

A Section 162 executive bonus plan is the formal name for a type of employee life insurance policy, referring to the relevant section of the U.S. Internal Revenue Code, 26 U.S. Code § 162. The employee owns the policy, which provides a death benefit, and the company pays the premium on their behalf. The policy may also have cash value which grows over time and is tax-deferred.

At retirement, the employee can take the policy with them as they exit the business. Perhaps they no longer need the death benefit protection because, for instance, they are an empty-nester with no dependents at home, or they are not in danger of having to pay estate tax. In this case, they can withdraw the cash value from the policy tax-free to gain extra retirement funds, make gifts to their children, or spend this money another way.

Employees should check with their employer and their insurer to understand the impacts of leaving the company before retirement.

You could also consider key person life insurance, which can protect your business financially in the event you lose a key member of your team and need to replace them. This type of life insurance is usually owned and paid for by the company, not held by the individuals themselves.

As the business owner, your company could take out life insurance so that, if you die, the company can buy your ownership interest from your estate. In this scenario, the company would provide your estate (and by extension your family) with money for the future, while the company would have control of your shares, enabling it to continue operating.

Some families that want to keep shares in the business to generate an income stream for the future might also purchase life insurance on the surviving spouse. Upon their death, this could cover the cost of any estate settlement fees or estate tax due as a result of owning these company shares.

Sometimes, some family members want to sell and others don’t. Without the funds to buy each other out, this can create conflict.

As often as successful business owners do estate planning, they rarely plan to give away 100% of their company. Very often, even though they have reduced the value of their taxable estate, they still need to have cash available for their family to deal with tax liabilities after they die.

For example, if a business partner dies and the businesses transitions to a surviving partner, the family of the deceased may need to find the funds to pay estate tax.

If they have no liquid assets to draw on, the company’s shares may have to be sold to the surviving partner or a third party. If the surviving partner doesn’t have the liquidity, selling to a third party may be the unintended and perhaps unfortunate alternative. Insurance can mitigate this risk. A buy-sell agreement can be arranged in several ways to provide the ready cash a family needs.

For example, two owners could hold life insurance polices on each other in case one of them dies. This is called a cross-purchase agreement.

When this policy pays out, it gives the surviving owner the funds required to buy out the deceased owner’s shares. It is also possible for the company to use the key person insurance scenario mentioned earlier to buy out the estate.

If there are more than two owners, they can set up a trust to hold policies on all the owners which simplifies the buyout and redistribution of ownership shares following a death.

Lastly, another family scenario: If a married couple owns a business together, when both are deceased, the fair market value of their business forms part of their estate. Their family will then have to choose whether to keep the business or sell it. This is often a decision on whether to go into debt or borrow from the government, if they do not have the cash on hand to pay the estate taxes but want to keep the business.

Sometimes, some family members want to sell and others don’t. Without the funds to buy each other out, this can create conflict. By making financial concerns less pressing, life insurance can be the glue that helps keep a family together at the end.

Life insurance can be a fantastic tool to reduce risk throughout the life of your business. Of course, taking on an insurance plan can come with its own risks; make sure to review any policies carefully to understand what they do and do not cover, and discuss with your lawyer.

When used correctly, both liability insurance and life insurance can help you protect what you’ve built, protect your family, and make succession planning easier to help ensure a bright future for both.

_______________________________________________________________

1Commerce Institute. "What Percentage of Small Businesses Fail? 2024 Data Reveals the Answer." https://www.commerceinstitute.com/business-failure-rate/, Accessed January 14, 2025.

Stay on top of the latest news and insights from BMO Wealth Management

Stay on top of the latest news and insights from BMO Wealth Management

Join our community to access insight-driven content as soon as it’s published.

All fields are mandatory.

The information you provided above will be used in accordance with the terms of our Privacy Policy.

Thank you for signing up for the BMO Wealth Newsletter.

Connect with a BMO Wealth Management professional about your needs.