These competing interests can devalue or even tear a business apart — preventing family-business owners from transferring it to the next generation. Understanding the following five dynamics may help owners manage the inherent conflicts between business and family, in ways that both increase value and ensure longevity.

1. Financial control vs. human capital

Conflict

When personal assets and cash flow are tied to a family business, it’s only natural for owners to want to retain full control.

However, human capital is itself a major asset. It may seem counterintuitive, but allowing others to rise into leadership positions — making the business owner replaceable — can increase the value of the business, because its success won’t rest entirely on the owners’ shoulders. With capable, talented people in the business, it’s more likely to grow.

Plus, once the business is transferable, owners can start thinking about retirement.

Recommendations

- Recruit and mentor great managers, then trust them with the authority to fulfill their responsibilities.

- Hold managers accountable: “Inspect what you expect.”

- Keep business finances separate from personal finances. Don’t treat the business as a personal check book.

Case study in the value of human capital

Jim was only a few years from retirement. He had built a very successful HVAC installation and servicing business. He knew every customer by name, had an annual Christmas party with his vendors, customers, and employees, and even came in on the weekends to work on scheduling and ordering parts. He knew he had a lean, mean, profitable business. He put two kids through college and belonged to the best country club in town.

When it came time to look for a buyer, Jim went to his trusted advisor. Unfortunately, the advisor said that if Jim were to exit, the business would be worth much less than Jim believed — because most buyers would not be able to take over and hit the ground running. There would be significant transition time, along with risks associated with losing customer, vendor, and even employee relationships.

Furthermore, Jim would need to stay on to assist — working to pay himself off. If Jim had allowed others to assume more responsibility within the company — if he had built human capital — his business would have been more valuable to potential buyers.

2. Legacy vs. mortality

Conflict

Most business owners understand the rationale behind exit planning, but they resist it on an emotional level. It can be hard for business owners to face their own mortality. They may get so caught up in steering the ship and keeping it sailing that they forget to plan for the inevitable. A well-thought-out plan can protect family businesses from floundering if the unfortunate occurs.

Recommendations

- Take the time to create a written transition plan.

- Incorporate measures to allow for a seamless passing on of responsibilities and authority.

3. Business vs. family

Conflict

Family-business owners have an allegiance to their family members as well as to the business (including employees, customers, and vendors). Often, those goals do not align, specifically when it comes to birthright. If children want to take over the business in the future, it’s important to consider whether they have the necessary skills.

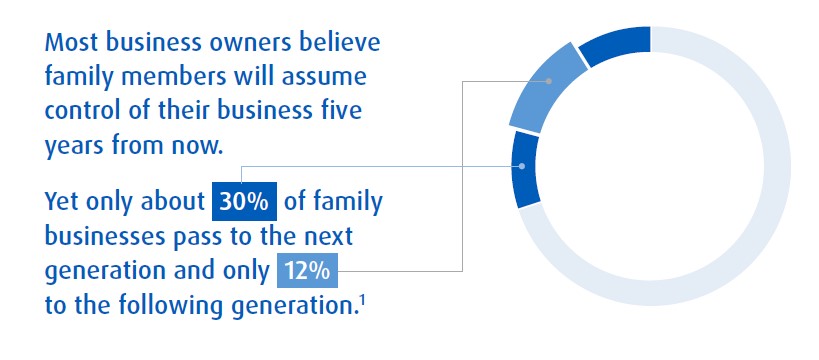

Many business owners hope that family members will retain control of their businesses in the future. Yet, only about 30% of family businesses pass to the next generation — and only 12% to the following generation.

If the business has co-owners who are not family members, they will have different opinions and goals, adding a third layer of complexity.

Recommendations

- Communicate with children early (before college) to gauge their interest in the business.

- Help interested children get the proper education, experience, and mentorship. Consider having them work outside of the company for a time before joining.

- Recognize that the business supports the family and, therefore, the family must abide by business governance and best practices.

- Formalize governance, including a separate family council, management team and board of directors, each with its own “constitution,” so they can make decisions independently and then communicate on shared governance matters.

- Instill family philosophies and constitutions in the business mandates. This way, it’s not the business versus the family, but rather the business with and for the family.

4. Older generation vs. younger generation

Conflict

The older generation “speaks a different language.” Senior business owners may be more conservative in order to protect the company’s financial resources. As a result, they may be slower to pursue change. On the other hand, the younger generation often wants to force faster change, feeling they know the current pulse of the market better than their elders, whom they see as behind the times.

Recommendations

- Have the younger generation get some skin in the game by making them owners. Perhaps they can buy in using nonvoting shares; even just a small amount at a time will be worthwhile.

- True-up compensation for family members if you’re underpaying them, possibly by allocating the difference to a share purchase program. This should help their sense of value and create better morale.

Most business owners understand the rationale behind exit planning,

but they resist it on an emotional level.

Case study in generations

Bob, owner of an IT consulting business, had two children: Jim and Kathy. Kathy was one of Bob’s best salespeople, and Bob thought she would be ideal to run the company at some point.

Jim had little involvement with the business. Wanting to treat his children equally, Bob arranged to leave 50% of the business to each child when he passed away. Kathy succeeded him as the leader and continued to grow the company. Jim looked forward to the quarterly distributions.

Soon after, Kathy saw the need to divert some of the earnings to the future growth needs of the company (rather than pay out dividends), but Jim was unwilling. He simply did not understand the business need. Since there was no majority owner, the company began to lose sales to competitors and the distributions dwindled.

If Bob had recapitalized the business before his death (giving Kathy voting shares and Jim non-voting shares), Kathy would have had the ability to move the business forward, while Jim would have benefited from its continued growth. If they ever sold the business, both could have shared in the profit. Equal is not always fair (and fair is not always equal).

5. Business ownership vs. wealth transfer

Conflict

Some children may be active in the business and others may not. How can business owners equalize the wealth they transfer to each? Should children who are not part of the business be bequeathed business ownership?

Recommendations

- Keep in mind, fair does not always mean equal.

- Consider life insurance, although this still may not be able to guarantee equal value.

- In order for all children to have some ownership in the business, allow only non-voting shares in the hands of those who do not work for the company.

Dealing with family-owned business challenges is best handled with the advice of a seasoned advisor who collaborates with a team of relevant experts. Wealth planning, estate planning, exit planning and governance planning all come into play as family business owners document — and over time update — their intentions and expectations. For additional information about family business dynamics, speak with a wealth professional.

Feel confident about your future

BMO Wealth Management — its professionals, its disciplined approach, its comprehensive and innovative advisory platform — can provide financial peace of mind. For greater confidence in your future, call your BMO Wealth Management Advisor today or let us help you find a Wealth Professional.

_____________________________________________

1Family Business Association, “Letting Go of the Reins,” accessed March 26, 2025, https://familybusinessassociation.org/article/letting-go-of-the-reins