First, children or other relatives with a stake in an inheritance often have their own ideas on how, when and how much of that inheritance they should be entitled to. While parents generally want to be fair, they may have more confidence in some family members than others.A business that will support generations of family will need a highly effective management team. Will children be effective managers? Will children want to manage?

Additionally, marriages where there is significant wealth can often result in resentments when a pre-nuptial agreement is required. Also, families may have special concerns for certain family members that have caretaking needs or major health issues that require a caretaker for life.

All of these concerns require advanced planning and decisionmaking — but families are often hesitant to do so, because it may cause discord or outright breaks in the family relationships. How then, can a family proceed with estate and business planning?

This article is intended for the family business owner facing their inevitable need to retire, step back or prepare for transfer at death who wants to face these difficult decisions head-on by creating a well-thought-out business succession wealth transfer plan.

A business that will support generations of family will need a highly effective management team.

Planning for the unexpected

A “nuclear family” consisting of parents and children may seem fairly easy to plan for. When the children and the business are young, the goals seem simple: income for living, protection from emergencies and unforeseen events, saving for children’s education and health care.

But 20 years later, the family will likely have acquired many more members through marriage, birth, divorce and remarriage. Over time, two parents and three children could easily become over 15 to 20 people. Some, although deceased or divorced, may still have ties to the family wealth as a result of inheritance or court documents. If a plan is not in place to deal with these eventual realities of being part of a family of means, problems can arise quickly.

In addition, where a family business is concerned, the business owners have more than just supporting the family to consider. They also need to concentrate on the business itself, including maintaining day-to-day operations and engaging with existing management. Often, there is an expert management team in place that is responsible for the growth, stability and profitability of the business — which allows the business owner to enjoy the business profits and build a viable inheritance for the family without having to handle every aspect of the business themselves.

This creates another set of concerns for the business owner: Would family who inherits as owners be equally expert at working with the existing management team? Perhaps one child might be skilled owner/manager material and others, not so much. Would current management get along with an inherited owner or would they leave? If they do leave, would the business still be as successful?

To account for variances in family members’ abilities, creating a business governance plan may be a good first step. This is the document that describes your business vision and a set of values that the business encourages, and that lays out the roles, responsibilities and skill sets required for each of the major positions that make the company successful.

The document can clearly articulate the skills required for each role. This is often made part of the HR file and used for hiring purposes. However, it can also be very important in making an inheritance plan and deciding who, if any, of the family members could fill any of those important roles.

The family should understand the expectations both for their future roles in the business as well as their expected role as individuals whose actions affect and reflect on the business. This could include things like a required education or skills training component, a code of public conduct and a structure whereby the family assets are protected from negative financial events like lawsuits, divorce or health catastrophes. It should separate the family wealth from the business as much as possible.

Identifying potential issues

A key step in preventing issues that may keep a business from future profitability — and possibly leave heirs with little to show for all its success — is to identify your specific risk factors and concerns. These could include:

- Are you a sole owner/manager? What happens if you die? What do you want for your family?

- Do you have non-family management? How critical are they? Does family have expectations of replacing management at some point? And how might this affect the company financially?

- What will you do about marriages and divorces regarding who can own stock or work in the business?

- How will future family ownership affect future management decision-making processes? Should it?

- If family will enter the business, what criteria would you set regarding age, skills or education? Family can have advantages, but how will management react to any favoritism?

- How can you be fair to children in and out of the business?

These are just some of the potential issues that can create conflict for an owner juggling the dynamics of family harmony and business profitability. Facing the issues and providing some framework to deal with the issues may be a better solution than having a business succession battle fought out in court or that leaves the business broken — or worse, unable to provide for your heirs.

Once you know your issues, you have a starting point for addressing them together through tough decisions, both as a family and a business. Very often, the business founder/owner and CEO makes the final key decisions on most things having to do with the business, and perhaps the family as well.

These decisions may be conflicted. As an example: Management suggests a financial investment in a new technology that can speed up production or distribution. But the owner/CEO may have three children currently in college and planned to take a larger than usual distribution to pay tuition. Granted, education planning would have been a good idea, but these are the kinds of conflicts that arise.

Valuable reads as you go through the family and business governance processes

Family Business Succession, Your Roadmap to Continuity

Lecouvie and Pendergast, Palgrave Macmillan, 2014

Family Business Key Issues

Kenyon-Rouvinez and Ward, Palgrave Macmillan, 2007

Strategic Planning for the Family Business

Carlock and Ward, Palgrave Macmillan, 2001

The Family Constitution, Agreements to Perpetuate Your Family and Your Business

Montemerlo and Ward, Copyright Family Business

Consulting Group, 2005, 2011

So how does one decide?

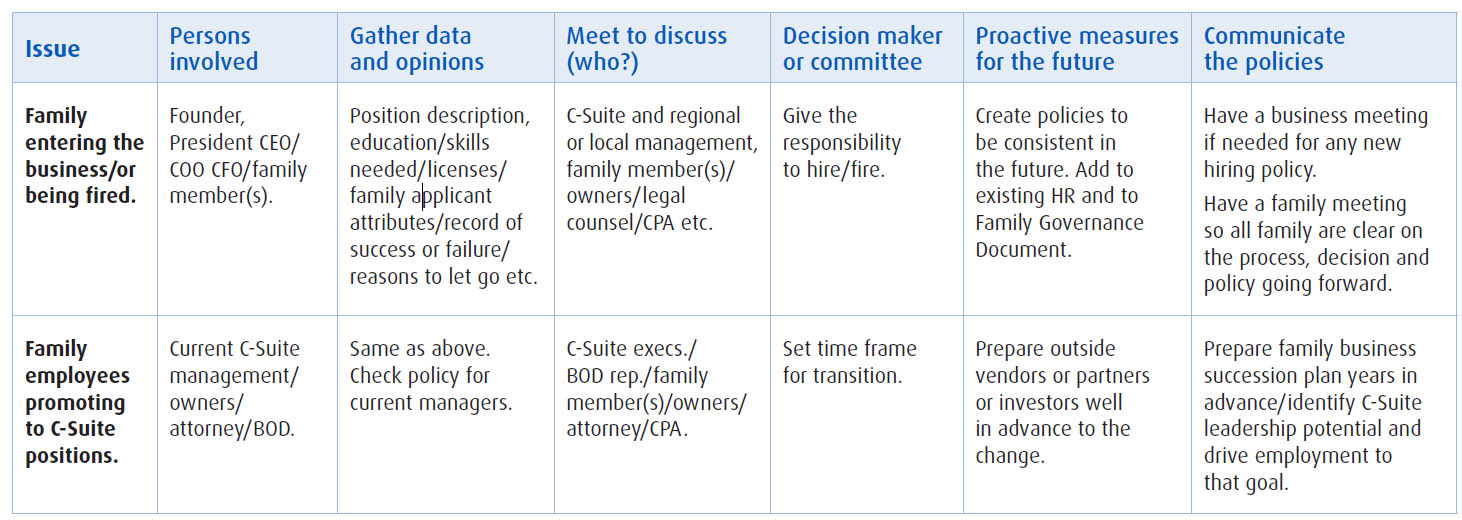

Perhaps creating a system for making decisions can be of value. Let’s look at the issue of family entering the business as an example. The owner can make all the decisions and management would have to live with it, or management could be included in the decision making process.

It makes sense to have happy managers, so let’s look at a process for making this kind of decision that can partially eliminate the family dynamic of having the owner’s child enter the business and thinking he/she is now running the show, which upsets and frustrates good management to the point where they may leave and the profitability demise begins.

Below is an example of an “involved” decision making process. It allows for input from a number of concerned managers or current or future owners and it is about creating the “policy” that will then stand over time. The policy need not be equal or fair — just considered and accepted.

Making decisions is important. Communicating them so that expectations are set and so that family, as well as management has time to accept and adjust to the decisions is equally important.

Implementing best practices

To summarize: Family dynamics and business success are hard to separate. But you may help mitigate the risk that your business and your family will be harmed by lack of planning if you:

- Identify specific issues that can cause conflict between family and the business.

- Determine a decision making process that includes interested parties and create the policy together.

- Consider developing a family and business governance document to memorialize decisions and policies outside of and in addition to your HR policies.

- Early planning and communication are key to your policies success.