The decision to support hand-selected companies can be especially meaningful when an investor recognizes the untapped potential of a founder from a historically marginalized group, such as women and minority founders. Angel investors understand that these entrepreneurs need capital to build successful companies, drive innovation and reshape industries.

Other angels focus on investing to support causes they want to champion. Whether it's funding medical research inspired by a loved one's health journey or supporting innovations in sustainability, the desire for impact matters as much or more than the need for immediate financial returns. An added bonus of investors with a personal connection to a cause is that it often leads to deeper engagement and more meaningful support for portfolio companies.

Moving the needle: Beneficiaries of angel investing

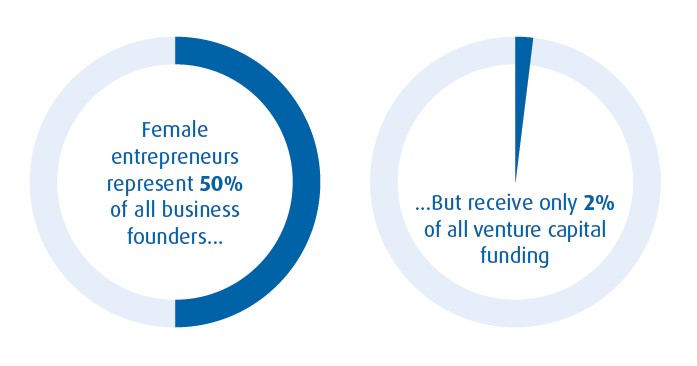

Unfortunately, female entrepreneurs, who represent half of all business founders, have historically received just 2% of venture capital funding.1 But angel investors can impact this glaring imbalance by prioritizing their desire to help women founders over their quest for short-term investment returns.

Female investors, in particular, can often relate to the struggles of women who are trying to raise venture capital. These investors have considerable clout in the marketplace and access to capital. After all, women control about $31.8 trillion in global spending2 and drive over 85% of U.S. consumer spending.3

As more female investors come onto the scene, there has been a transformation in angel investing demographics that helps drive values aligned financing. What was once a male-dominated space has evolved to nearly equal gender parity4 among investors. This shift is particularly significant given the persistent funding gaps in traditional venture capital for women and entrepreneurs of color.

Due diligence: Mitigating risks of angel investing

While passion for a cause or a desire to support diverse founders often drives initial interest in supporting historically underfunded entrepreneurs, successful angel investing still requires a disciplined approach. Experienced investors know the importance of thorough due diligence – even when their emotions are in the driver’s seat.

Important prerequisites to making any venture capital investment include:

- a well-defined understanding of market potential

- careful evaluation of the founders and their capabilities

- a clear understanding of governance structures

- a careful review of valuation terms and investment contracts

The above steps can help protect against the risks inherent in putting a significant amount of money into just one company, especially startups can take a long time to become profitable, and some never will.

Another way that angels can help mitigate risks is by taking advantage of the power of collective investing. Investment networks and groups play a crucial role in this process, offering collective wisdom and resources. Moreover, relatively small individual investments can aggregate into meaningful funding rounds when pooled with other likeminded investors. These communities also provide valuable educational resources and mentorship opportunities for investors with a passion for particular companies or sectors.

Financial planning considerations are equally crucial. Successful angel investors should carefully integrate these investments into their broader portfolio strategy, considering factors like risk tolerance, timeline for returns and tax implications. Professional guidance from tax and legal advisors can help to ensure that your investments align with your overall financial goals. It’s important to think critically, ask questions and develop a budget for angel investing.

The power of uniting dollars and sense

With traditional venture capital funding5 having slowed during the past few years, angel investors are a crucial lifeline of support for early-stage companies. The stability and resilience of the angel investing sphere demonstrates that investment decisions driven by both passion and pragmatism can survive market volatility.

The key to this survival is to find the right balance between dollars and sense. Ideally, angel investors should be looking for investment opportunities that:

- Preserve their values while building wealth.

- Create a legacy that reflects personal principles.

- Provide financial support and build the confidence of startup founders.

- Develop a unique investment signature that puts ideas and entrepreneurs ahead of ROI.

Passion-driven investors should trust their instincts, but vet their assumptions. It’s also important to set realistic expectations. Many startup companies fail long before investors realize any kind of return. But moving the needle on something you care about might be a sufficient reward.

By combining passionate support for entrepreneurs with rigorous investment practices, angel investors can help to create a more inclusive and sustainable funding ecosystem. This balanced approach offers the potential for meaningful social impact in the short term, with the possibility of financial returns further down the road.

_______________________________________________________________

1 Morningstar (2023), https://www.morningstar.com/alternativeinvestments/women-founders-get-2-venture-capital-funding-us, Accessed January 2, 2025

2Girlpower Marketing, https://girlpowermarketing.com/statisticspurchasing-power-women/, Accessed January 2, 2025.

3Forbes (2024), https://www.forbes.com/sites/digitalassets/2024/03/07/who-runs-the-world-women-control-85-of-purchases-29-of-stem-roles/, Accessed January 2, 2025

4Boston Business Journal (2024), https://www.bizjournals.com/boston/news/2024/07/08/report-angelinvesting- 2023.html, Accessed January 3, 2025.

5Axios (2024), https://www.axios.com/2024/10/11/venture-capital-dealslow-liquidity, Accessed January 3, 2025.