Looking for something else?

Welcome

For several years running, high-quality Fixed Income has left investors with little to cheer about. Over much of the past decade, yields were unattractively low. More recently, during 2022 and 2023, the rapid rise in interest rates was a gale-force headwind to bond market performance. But we believe all that’s changing. Through a combination of higher yields and more benign Federal Reserve policy, Core Fixed Income appears poised to resume its traditional, constructive role in investment portfolios. Put simply, bonds are back. Finally.

Interest Rate Outlook

For more than a year, we’ve messaged our view that inflation had peaked, that its downward trajectory would persist, and that the economy would manage a soft landing. Fortunately, economic forces seem to be playing out as expected. That improved economic backdrop should allow the Fed to pivot later this year and begin reducing short-term interest rates towards a neutral policy level. We envision the Federal Reserve making a few quarter-percentage point cuts this year and then extending its rate-cutting campaign into 2025. We believe the precise timing and magnitude of Fed easing should ultimately prove less important to market stability than the Fed’s overall posture and policy direction.

Although short-term rates should begin a gradual decline by mid-year, we expect intermediate and longer-term yields to stabilize and even rebound into year-end. Bond prices climbed rapidly over the final two months of last year, pulling intermediate and longer-dated Treasury yields below what we consider equilibrium levels. But as economic stabilization sets in later in 2024 — and as the market comes to terms with large structural deficits in the federal budget and the potential for accelerating growth by year-end — we believe longer-term yields are likely to push back higher. Between those moderately higher long-term yields and a few Fed rate cuts by year-end, we expect the yield curve (Exhibit 1) to end 2024 roughly flat, with both Fed funds and the 10-year Treasury closing in the mid-4% range.

Current Positioning

Within bond portfolios, we’re currently positioned approximately neutral to benchmark duration. Last fall, intermediate and longer-dated yields rose sharply, and to take advantage of those higher yields, we recommended extending duration toward benchmark. However, those higher levels didn’t last long — and through November and December, Treasury yields reversed course, pulling the benchmark 10-year back down to its current trading-range between 4.0% and 4.30%. At present, we believe investors should stay near or slightly below benchmark duration, as we see there is greater upside risk in yields than downside risk as we look toward the second half of the year.

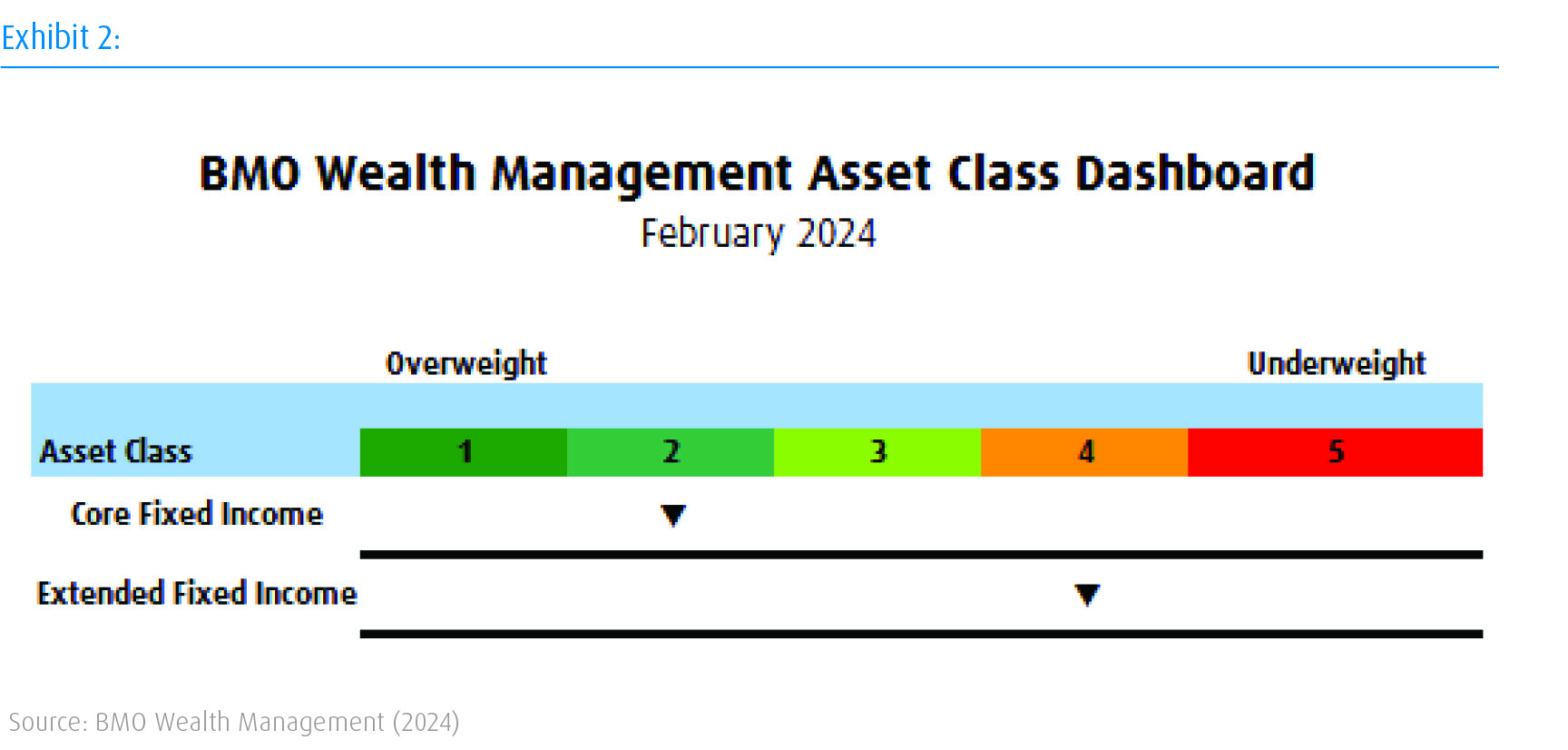

We’re also recommending investors remain at, or slightly above, strategic target in Core Fixed Income (Exhibit 2), focusing their exposure on high-quality bonds, as spreads over Treasurys within the Credit and High Yield segments are tight. Meanwhile, although our Extended Fixed Income allocations are slightly underweight strategic target, within that space we do still favor Reinsurance/Catastrophe Bonds — one of our high-conviction tactical positions. The Reinsurance space offers attractive yields, as companies that provide reinsurance are experiencing strong pricing power on premiums set for 2024. Additionally, the asset class has unique short-duration characteristics and low expected correlation with other assets.

In the event of equity market volatility, both high-quality Fixed Income and Reinsurance/Catastrophe Bonds should provide a measure of stability in portfolios. For Core Fixed Income, we expect the asset class to achieve mid-single-digit returns unless longer-term interest rates turn sharply higher later in the year. This dual function — yield plus protection — has finally returned for bond allocations.